Blockchain mania peaked in December 2017 when prices for bitcoin, the first application of the digital ledger technology, surged to a record high of almost $20,000 in one of the most dramatic increases of any asset in living memory. Since then, prices have fluctuated wildly, earning bitcoin comparison with the tulip mania of the Netherlands in the 17th century. Love it or loathe it, however, an increasing number of start-ups in a variety of industries, from finance to energy, healthcare to food, and even – you’ve guessed it – art are embracing blockchain, But what potential does blockchain hold for the traditionally conservative and technophobic art market?

To understand this requires a peeling-back of jargon to reach the core principles underpinning the technology: transparency and accountability, two areas in which the notoriously opaque art industry is lacking. Here, a handful of blockchain-powered art registries that record works of art and their trading history are leading the way. They include Artory, which was founded in 2016 by Nanne Dekking, the chairman of TEFAF, and registers information from vetted partners. Codex, meanwhile, established in 2017 by Mark Lurie, stores provenance information about art and collectibles. Some 5,000 auction houses are now using the firm’s registry.

The idea is that any art title securely stored on the blockchain is accompanied by verified certificates of authenticity, provenance records, cataloguing details and sale prices. This allows companies operating in related fields such as insurance, shipping, asset-backed lending and artist royalties to interact confidently with the data, which is permanently recorded and cannot be tampered with or selectively omitted.

The problem is that such systems can be ‘corrupted with bad information’, according to Dekking, who was speaking in July at the first Christie’s Art + Tech Summit, dedicated to blockchain. Put simply: ‘If you put crap in, you get crap out.’ Similarly, services such as authentication are carried out independently of the blockchain, so due diligence must be done before inputting the data. Companies such as Tagsmart, which forensically authenticate works with ‘DNA tags’, are the next step in providing the elusive missing link between the physical object and its digital record.

Another issue is what Bernadine Bröcker Wieder, the chief executive and co-founder of Vastari, which co-organised the summit, describes as the ‘VHS-Betamax problem’, whereby several non-compatible registries emerge at the same time. ‘Records need to be transferable so you can follow the chain even if it is saved on different protocols,’ she says. Vastari, which matches exhibition producers with venues, is partnering with the diamond registry Everledger to create a database of exhibition histories to ‘measure a work’s value based on visitor figures and audience engagement, as well as the current methodology of valuation through auction prices’.

Other market players envision a utopian future in which there exists a single, industry-wide record for all fine art purchases, shared among auction houses, galleries and collectors and accessed via a digital ‘key’. According to Christie’s photography specialist Anne Bracegirdle, such a registry would ‘organically create a more comprehensive version of a price database without the intermediary or the access cost’.

The future of the market’s intermediaries, namely auction houses and dealers, has been called into question by blockchain initiatives. John Zettler, co-founder of the RARE Network, which sells digital art, believes the secondary market is at risk, partly because smart contracts, which are written on the Ethereum blockchain, ‘can do all the clearing of the secondary exchange’. They also offer artists a percentage of secondary market sales, potentially solving a long-running problem in the market. One adviser for Portion, a new auction house being built using cryptocurrencies and blockchain technology (due to launch in October), says clients who choose to use Portion’s proprietary ‘Porti’ tokens will eliminate all third parties, intermediaries and fees.

One area of the secondary market that is gaining momentum is tokenisation, whereby portions of blue-chip masterpieces are traded like assets. In June, Andy Warhol’s 14 Small Electric Chairs (1980), valued at between $5.1m and $6.2m, became the first work of art to be split into portions and auctioned using blockchain technology. The sale has been organised by the London gallery Dadiani Fine Art (which tried to sell the canvas at Bonhams in 2016 and retains a 51 per cent stake in the work) in partnership with the blockchain platform Maecenas, and was still ongoing at the time of writing. With one million shares available, the final share price will hover between $5.10 and $6.20 (based on the June valuation).

The aim, says Marcelo García Casil, the co-founder and chief executive of Maecenas, is ‘to bring greater transparency to the traditional art investment model’. A work’s share price could be published a few times a week, rather than every five or ten years or more, as with pieces that are auctioned through the traditional channels. Unlike many blockchain ledgers, which are private, Garcia Casil says his firm would consider making its database public.

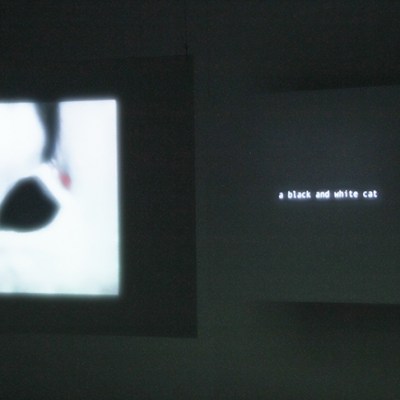

Blockchain is giving the digital art market a welcome boost. Traditionally the market for screen-based works has suffered because the art is easy to reproduce and distribute. But now, with blockchain, you can make digital art scarce, or even unique – the holy grail for collectors. As a case in point: Celestial Cyber Dimension, a unique digital image of a cat or CryptoKitty, sold for $140,000 in May against an estimate of $25,000–$30,000. ‘This is not a fad. This is an emerging market that has been enabled by blockchain technology,’ Bracegirdle says. ‘Blockchain gives digital artists the ability to edition and sell their work and therefore create a value structure and marketplace.’

The big question now is whether blockchain will become more mainstream in the art market. After all, global investment in art-related blockchain projects amounts to almost nothing. Crucial legal stumbling blocks such as data privacy, cyber security and competition laws remain. Jonathan Kewley, a London-based technology lawyer, predicts global regulatory oversight will be one of the major issues facing blockchain firms and users in the coming year, since the majority of blockchain projects rely on largely unregulated cloud platforms.

But, if ever there was a sign that the old guard might yet be turned, it was the announcement at the summit that Christie’s is working on a soon-to-be revealed blockchain project. As Bröcker Wieder notes: ‘If that happens with one of the most established institutions in the art world, then there is hope.’

From the September 2018 issue of Apollo. Preview and subscribe here.